I have got over 20 years of finance history of every payment, every transaction, transfer, etc that I originally started in MS Money back in the day, and all was good… I then moved to Linux (Microsoft never did Linux back then) and the easiest import with similar functionality was MoneyDance which was cross-platform, but paid and proprietary. This also served me very well with all the full functionality I needed, and I bought the forecasting plugin. But both have required the odd paid renewal to upgrade every three years, and the latest update has integrated that paid plugin, and it seems the annual renewal cost will become a bigger thing now.

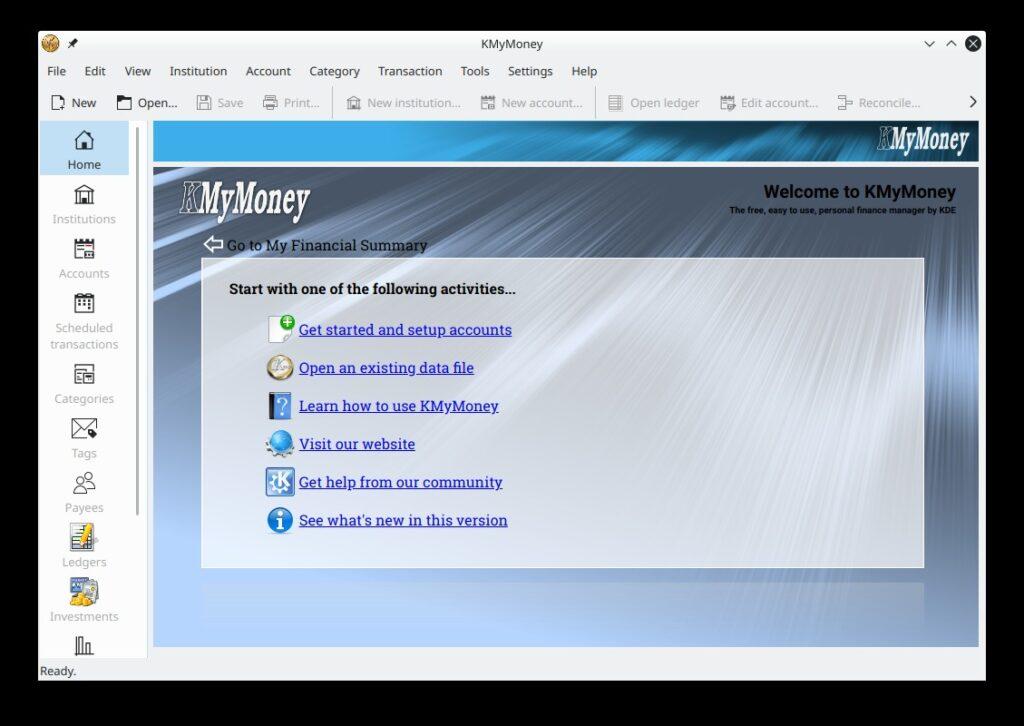

So I took stock of my requirements I use e.g. split category transactions, scheduled transactions (monthly, annually, bi-weekly), calculations to add amounts and then VAT, balance forecasting on my current account (my biggest need as I have credit cards to pay and lots of debit orders, subscriptions and annual payments), import from QIF format, budget categories, statement recons, etc. I was comparing GnuCash, HomeBank, Skrooge and KMyMoney. I tested by importing my QIF files from MoneyDance to each package and seeing if I could get the correct balances as at today’s date, and the forecasts right with the scheduled transactions. I’d always recommend one does this, as individual preferences differ, and you can’t just go on the list of features presented.

GnuCash’s double entry system is really suited more to a business than for my use, HomeBank had a nice interface and vehicle management but I struggled a bit with their terminology language, Skrooge also had a nice interface but I struggled to get to see a detailed forecast of balances, and KMyMoney actually hit all the buttons for me.

It was not all plain sailing, as I did have some issues:

- If I imported my current account first, the app would create any “linked” transfer accounts, but some, which were loans accounts, appeared as asset accounts. So importing everything else first, and ending with the current account, solved this little issue as those other accounts were created as the correct type of accounts.

- I realised I had created a loan account as an “asset” account in MoneyDance and this could also be what gave problems.

- I decided to only import from 1 March 2020 to keep things simpler, but when I tried to set the opening balance for each account and date it to 1 March 2020, it gave errors. Turns out, KMyMoney creates an account called Opening Balances for this, and it is dated today. As soon as I changed the Opening Balances account to 1 March 2020, the problem was solved.

- I though the balance forecast was not working as it kept not factoring in the two test transactions I was watching out for. Turns out after more than an hour, this was my own fault, as somehow I got muddled with the months and had stated first transactions were in next month instead of later in this same month. So suddenly that came right.

- So yes I don’t have the ease of typing a $ amount in directly as “7 USD” and it auto converts to ZAR, but that is not too serious, and I also can’t enter my compounded amounts like this “(213+86)*1.15” but also not too serious as the pop-up calculator seems to handle that.

Yes switching from a package you’ve used daily for so many years is never going to be too quick and easy, and I’m running both in parallel for a month also to be sure, but I’m impressed so far with KMyMoney and hope it fully passes my final test. Certainly also HomeBank and Skrooge are worth considering, as well as even GnuCash. The important thing is to test each for yourself first.

#technology #financemanagers #finance #KMyMoney #money